I don't know why this hasn't already taken over the Internet .

Fear the Boom and Bust: Keynes vs. Hayek in a rap video

HT: Caleb Sjogren

From what I've read, the portrayal of Keynes as a playboy is historically accurate.

A gathering site for distantly dwelling friends

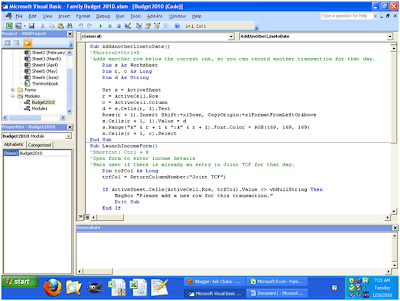

Though you won't have the module Budget2010 and its code. That's what I'm going to give you.

Though you won't have the module Budget2010 and its code. That's what I'm going to give you.

1. Source of income

2. Account that holds money (assets)

3. Account that you owe money (debts or liabilities)

4. Category of regular expenses

Groceries

Toiletries

Household supplies/Laundry

Clothes

Missions

Life insurance

Health care

Car insurance

Gasoline

Car maintenance

Rent

Renters' insurance

Electricity

Water/Gas/Garbage [all three of these appear on one bill]

Landline

My cell

My wife's cell

Dates

Social events

Travel

Other

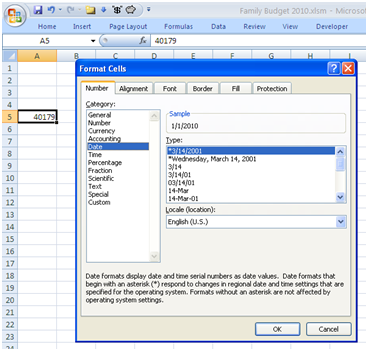

Now your 40179 is transformed into a date.

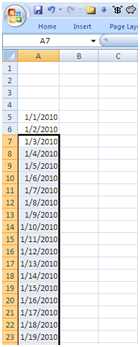

Now your 40179 is transformed into a date. To populate the rest of the dates for the month, create a formula in A6: "=A5+1". After you hit Enter, A6 should show 1/2/2010. You can copy A6, select the next 30 rows or so, and select Paste. You now have a month of dates.

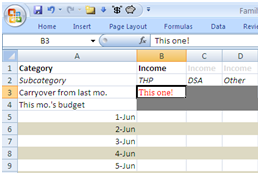

To populate the rest of the dates for the month, create a formula in A6: "=A5+1". After you hit Enter, A6 should show 1/2/2010. You can copy A6, select the next 30 rows or so, and select Paste. You now have a month of dates. If you select the cell highlighted as "This one!" in the picture above, you'll freeze the top two rows and the leftmost column so they're always visible.

If you select the cell highlighted as "This one!" in the picture above, you'll freeze the top two rows and the leftmost column so they're always visible.